Built for ViDA. E-Invoicing Made Simple

Bring AP automation and e-invoicing into one solution to get ahead of the digital regulations that are reshaping finance.

Act early, avoid the scramble

With ViDA reforms now signed off, e-invoicing and real-time reporting aren’t a question of if - they’re happening.

By 2030, they’ll be mandatory across the EU, and the first deadlines are already approaching.

The challenge? Every country is moving at its own pace. Some already run full B2B e-invoicing systems, while others are only just beginning. Different start dates, formats, and enforcement models make the landscape anything but straightforward.

For UK businesses, understanding the landscape is critical. Digital mandates are reshaping the way Europe trades - and preparation can’t wait.

What does it mean for you?

If you have an EU entity, you are managing:

Multiple timelines – staggered deadlines across the next five years, often with multi-stage rollouts.

Different formats and platforms – from Italy’s FatturaPA XML to France’s Factur-X and Poland’s FA_VAT, each country applies its own rules.

Evolving requirements – governments continue to adjust mandates, with further changes likely before 2030.

Financial penalties

Fines vary by country and can be harsh – charged per invoice, per day, or as a percentage of transaction value. Add interest on late VAT, and costs spiral fast.

Cash flow crunch

Wrong format or using the wrong channel can mean rejection. Payments stall, receivables chase instead of collect, and in some cases you can lose VAT deduction rights.

Operational disruption

Compliance demands strict formats, secure channels, and real-time reporting. Any slip creates data re-entry, system errors, and supply chain delays.

Damage to credibility

Frequent compliance failures raise red flags with tax authorities, customers, and suppliers. Once flagged, audits and investigations slow operations further.

What’s your next move?

Lower your risk footprint

Proactively align invoice formats and platforms to avoid fines, rejected invoices, and strained supplier relationships across multiple jurisdictions.

Keep your processes moving

Mandates roll out in waves - sometimes simultaneously across countries. Advance readiness prevents last-minute scrambles and manual workarounds.

Accelerate payment cycles

Structured, validated invoices move faster, reduce disputes, and speed up collections.

Gain real-time visibility

Integrated systems provide instant oversight of invoice flow and payment status across all EU subsidiaries, shifting finance from reactive to proactive.

Strengthen audit and tax transparency

Real-time compliance with tax authority requirements means faster, cleaner VAT reporting and audit resolution.

Position as a compliance leader

Early movers signal reliability and digital maturity to customers, suppliers, auditors, and tax authorities.

Future-proof finance. One platform for invoicing & compliance

Europe’s tax landscape is changing fast.

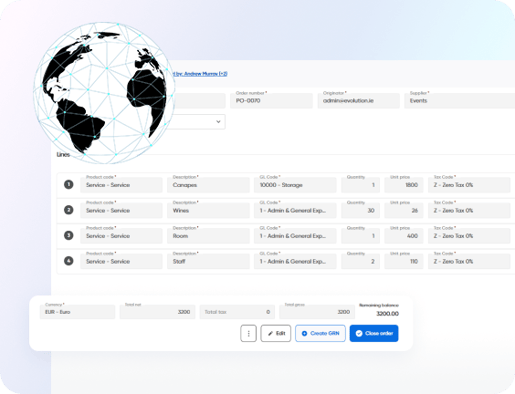

For UK businesses, the challenge is clear: prepare now or risk falling behind. That’s why we created Kefron AP, a cloud-based Accounts Payable automation platform with fully integrated e-invoicing.

It brings invoice automation and regulatory compliance together in one place - removing the need for multiple systems or complex integrations.

The result is a scalable, future-proof compliance solution that helps you stay ahead of ViDA while modernising your AP process.

Tech that does the heavy lifting

Automation

A blend of compliance and efficiency. Ensuring quick, precise e-invoicing with data accuracy and adaptability. Smooth conversion between file formats.

Specific on-boarding

Benefit from our professional onboarding project management, guiding you through the unique integration process in each country.

Seamless integration

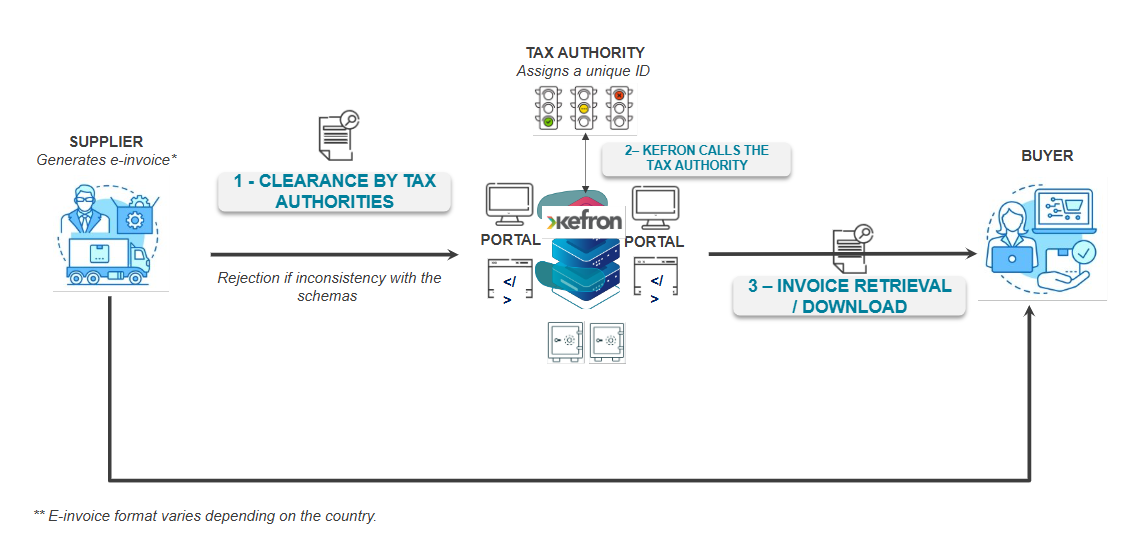

Seamless API integration with your ERP & Tax Authority Systems for AR/AP processes. Also includes updates for frequent Tax Authority rule changes

Compliance

A one-stop solution for country-specific CTC clearance, reporting, e-invoicing, and e-archiving in 100+ countries. Sidestep inconsistencies of diverse local providers.

How does it work?

Multi-country, multi-format

Every required format, mapped and validated against EN 16931 standards.

Group-wide visibility

One platform for every subsidiary, reducing complexity and cost.

Direct to tax authorities

Real-time API connectivity for submission, approval, and status tracking.

Future-proof

Automatic updates as regulations change

no costly re-builds.

ERP-ready

Integrated invoice flows remove manual touchpoints and cut rejection risk.

Scalable

A pricing model that works whether you’re live in one market or twenty.

Stay up to date with our e-Invoicing Information Hub

Clear guidance for confident e-invoicing.

Kefron AP includes AP automation and eInvoicing solution globally. It reduces time to pay suppliers, makes training for our own staff easier and provides more clarity and accuracy on reporting."

Guide for UK companies steering European subsidiaries through ViDA compliance

From chasing mandates to leading with certainty

E-invoicing rules are tightening fast. With Kefron AP, you stay compliant across every EU market - faster, simpler, and all in one place. Book a consultation today and let compliance take care of itself.

GET IN TOUCH

Ireland

53 Park West Road

Dublin 12, D12 F8RK

T: +353 (0)1 438 0200

United Kingdom

63-66 Hatton Garden

London, EC1N 8LE

T: +44 (0)118 997 7380